summit county utah sales tax rate

Web 271 rows Average Sales Tax With Local6964. Web Skip to main content Skip to footer links.

Utah 2022 Sales Tax Calculator Rate Lookup Tool Avalara

The Summit County Utah sales tax is 655 consisting of 470 Utah state sales tax and 185 Summit County local sales.

. Any sale funds in excess of the total amount of delinquent taxes penalties interest and administrative fees will be. Web Mass transit sales tax history pdf To get more information on town sales tax please contact. This rate includes any state county city and local sales taxes.

Utah has 340 cities counties and special districts that collect a local sales tax in addition to the Utah state sales tax. Summit County in Utah has a tax rate of 655 for 2023 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax. Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335.

The tax rate is determined by all the taxing agencies-city or. Web December 1 2022. The 2018 United States Supreme Court decision in South Dakota v.

Tax rates are provided by Avalara and updated monthly. UT Rates Calculator Table. Summit County collects on average 039 of a propertys.

Web The Summit County Ohio sales tax is 675 consisting of 575 Ohio state sales tax and 100 Summit County local sales taxesThe local sales tax consists of a 100 county. Due Date for 2022 taxes to. Youll need your 7-digit Account Number to make payment.

Web 93 rows This page lists the various sales use tax rates effective throughout Utah. Web Amount of Taxes. Web The median property tax in Summit County Utah is 1921 per year for a home worth the median value of 492100.

1 Penalty on Unpaid Taxes. Web The 2022 Summit County Tax Sale will be held online. Web Taxes are Due November 30 2022.

Click any locality for a full. 2020 rates included for use while preparing your income tax deduction. Final Deadline for 2022 Tax Relief Applications.

Web The latest sales tax rate for Summit UT. The amount of taxes you pay is determined by a tax rate applied to your propertys assessed value. This includes the rates on the state county city and.

Web Look up 2022 sales tax rates for Summit Utah and surrounding areas. Web The Utah state sales tax rate is currently. Web Summit County Sales Tax Rates for 2023.

Web 2022 Utah Sales Tax By County. 2020 rates included for use while preparing your income tax deduction. Web The total sales tax rate in any given location can be broken down into state county city and special district rates.

The Summit County sales tax rate is. Web The average cumulative sales tax rate in Summit County Utah is 778 with a range that spans from 715 to 905. Utah has a 485 sales tax and Summit County collects an.

Find Your Account Number Here. Web Download all Utah sales tax rates by zip code. Web This rate includes any state county city and local sales taxes.

Utah Housing Market Salt Lake City Trends Forecast 2022 2023

Faqs Summit County Ut Civicengage

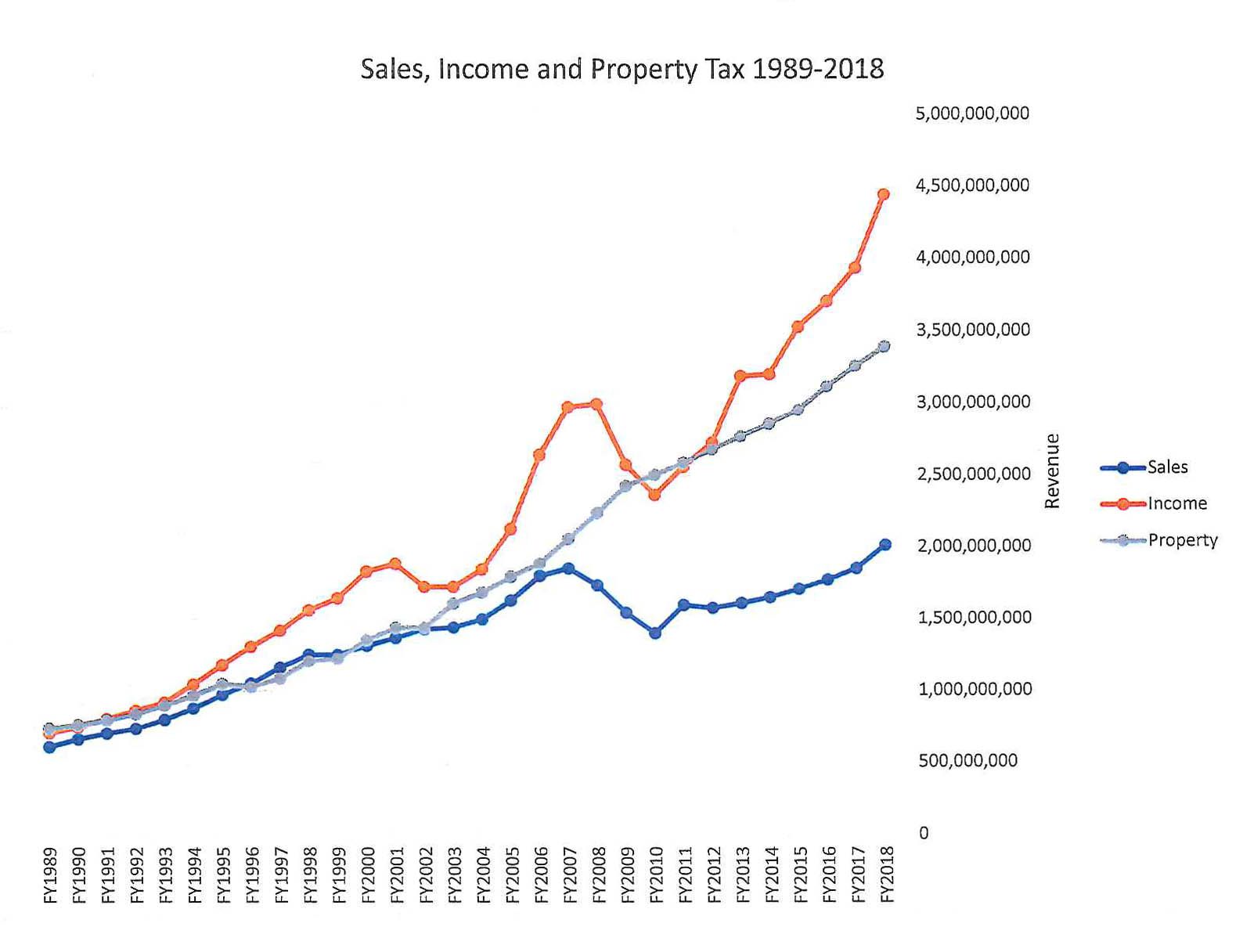

Truth In Taxation Summit County Ut Official Website

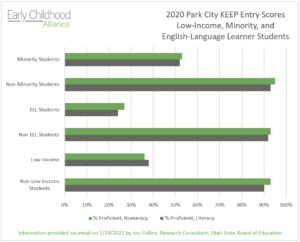

Early Childhood Alliance Park City Community Foundation

2 Years After The Nicotine Sales Tax Passed Revenue Has Supported Numerous Programs To Encourage Youth Health Summitdaily Com

All The Things The 2022 Utah State Legislature Did To Your Life

Coalville Utah Ut 84017 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Rap Tax Reauthorization Summit County Ut Official Website

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

Which Bills In The Utah Legislature Had The Biggest Impact On Summit County Parkrecord Com

Utah Sales Tax On Cars Everything You Need To Know

Utah State Income Tax Calculator Community Tax

Housing Market The Dark Side To Higher Home Values Is In Your Tax Bill Deseret News

San Juan County Ut Home Page San Juan County Ut